A few days ago I did a curve fit to bond interest rates. The yield curve that I obtained is shown below.

Here the x-axis is in months.

See these blog qualifications.

This blog is part of Barry Zillman's Bread Rolls or BZ Bread for short.

Also see my main business blog page.

A few days ago I did a curve fit to bond interest rates. The yield curve that I obtained is shown below.

Here the x-axis is in months.

Treasury note data is as of 5:22 p.m. EDT 10/16/08 (Treasuries data is from WSJ.com.)

1-Month Bill* 2/32 0.091

3-Month Bill* 8/32 0.497

6-Month Bill* 8/32 1.147

2-Year Note* -5/32 1.637

5-Year Note* -5/32 2.852

10-YR Note* -6/32 3.970

30-Year Bond* -1 1/32 4.254

It is interesting that the 1-month note bears an interest rate of near zero. Even though the short term inter-rate bank lending rate is very high, the Federal rate is near zero.

The Fed has been pushing down short term interest rates by instrumenting rate cuts. They keep pushing down the short end when it rises and this keeps the yield curve from inverting. Yield curve inversion, which we do not have here, is one indication of a recession.

The yield curve using data points is shown below.

And the fitted curve is given next.

Yet another attempt to make sense out of current treasury interest rate data is given here. I am finding it hard to find a nice analytic equation for the current interest data. Does this mean anything? I am not sure.

There is no question that this is a "fairly" bumpy time in the economy. I thought I would expend some effort to try to explain the current interest rate data (yield curve). I have not been successful so far.

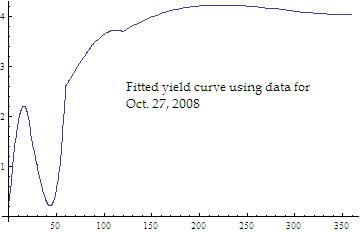

Treasury note data is as of 12:45 p.m. EDT 10/27/08 is given below.

1-Month Bill 0/32 0.319

3-Month Bill -4/32 0.757

6-Month Bill -4/32 1.321

2-Year Note -4/32 1.565

5-Year Note -7/32 2.614

10-YR Note -6/32 3.703

30-Year Bond 2/32 4.050

The fitted curve to the above data is given below.

I engage in practical mathematical applications and at the same time I engage in practical research studies. It may not be clear which is which. It is very possible that an approach that I take might not conform with accepted practices. I am attempting to analyze and interpret, and in some cases the results and analysis can be "unconventional".

Many of the results I present here are "experimental": just trying out a new idea or approach. I am doing a study or calculation just to see the answer. It may be that the result or technique has never been done before; so it may be hard to interpret results. Results might possibly not be obtained via standard techniques. Do not assume that items and approaches are conventional.

In other words what you are looking at may be a research "experiment" rather than a finished result. Thus be careful interpreting results.

New or original approaches to old problems are partially what I am looking for. Otherwise I tend to be conventional and "old fashioned". I don't believe in lying to get new truth. Old Truth is just fine with me.

Created by Chronicle v4.6

The

"George Schils Business Blog - BZ Bread

--

Business, Finance, Economics - Applications for Math and Statistics"

blog

is copyright 2008-2013 George Schils.

All rights reserved.